What Are CFDs? The Tech Behind Trading Stocks with Crypto

October 7, 2025 | by rlacyeon@gmail.com

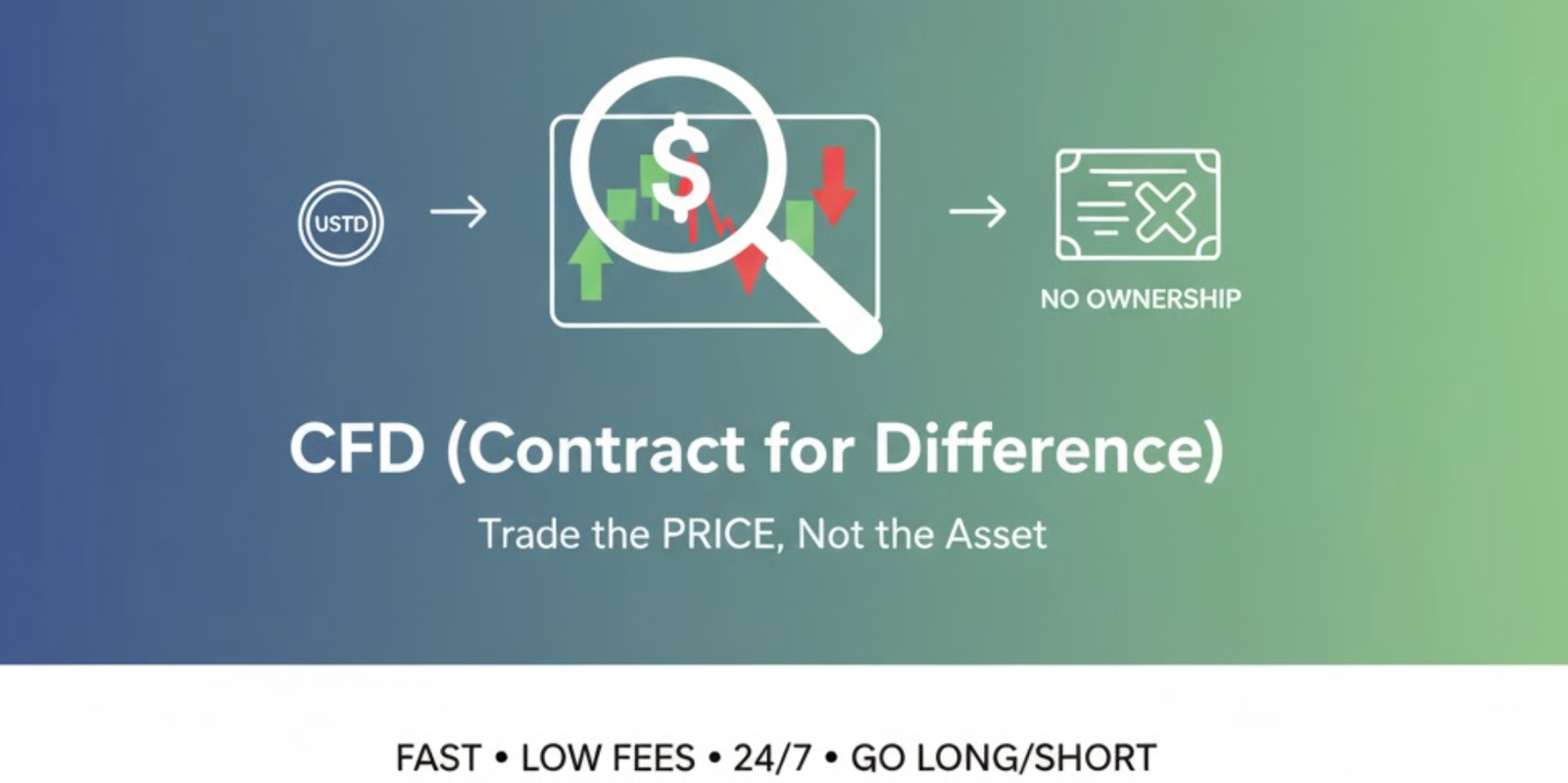

A CFD (Contract for Difference) is a simple agreement to trade the price difference of an asset (like a stock) without ever actually owning it.

This technology allows you to profit from both rising (long) and falling (short) markets.

Crypto platforms like Bitget now use stablecoins (USDT) as the margin (deposit) to trade CFDs of global stocks, completely bypassing banks and brokers.

Introduction

The Wall Street “Cheat Code” for Crypto Investors

You’ve made some good profits in crypto. You want to diversify into a solid stock like Tesla or Apple. But then you hit a wall—a slow, frustrating, and expensive maze of bank transfers, high fees, and waiting.

What if there was a way to bypass that entire system? A financial “cheat code” that professional traders have used for years to trade the stock market with speed and flexibility?

That tool is the CFD (Contract for Difference). And now, it’s merging with the world of crypto to change the rules of investing forever. Let’s dive in.

Chapter 1: So, What Exactly is a CFD?

Forget everything you know about “owning” stocks. A CFD is much simpler.

Traditionally, buying a stock means buying a tiny piece of a company. It involves brokers, clearinghouses, and a slow ownership process.

A CFD throws all that complexity away.

At its core, a CFD is a simple contract between you and a platform about a stock’s price.

Think of it like this:

You and the platform agree on the price of Nvidia stock right now, say $900. You believe the price will go up. You open a “buy” contract.

If the price rises to $920 and you close the contract, the platform pays you the $20 difference. If the price falls to $880, you pay the $20 difference.

That’s it. You traded the value of Nvidia stock without ever owning the actual stock. You simply profited from the price movement.

Chapter 2: The Three Key Ingredients of a CFD Trade

How does this simple contract become such a powerful trading tool? It comes down to three core components.

1. The Underlying Asset (The “What”)

A CFD needs something to track. This is the “underlying asset.” It can be the Apple (AAPL) stock price, the price of Gold, or even a market index like the S&P 500. The CFD’s price perfectly mirrors the real asset’s price in real-time.

2. Position (The “Direction”)

This is where CFDs get really interesting. Unlike traditional investing, you have two options:

Going Long (Buy): You believe the price will go UP 📈. This is what most people think of as “investing.”

Going Short (Sell): You believe the price will go DOWN 📉. This allows you to potentially profit even when the market is falling.

3. Margin & Leverage (The “How” – Featuring Crypto)

This is the final piece of the puzzle and where crypto comes in. To open a CFD contract, you don’t need the full value of the stock. You only need a small deposit, called margin.

And in this new era of digital finance, your margin can be your cryptocurrency (like USDT).

This is how it works: You use a small amount of your USDT as a deposit to control a much larger stock position. This is called leverage. A 10x leverage means $100 of your USDT can control a $1,000 position in Tesla stock.

It’s this mechanism that allows crypto exchanges like Bitget to build a seamless bridge between your crypto wallet and the global stock market.

Chapter 3: Is Trading CFDs a Good Idea? A Balanced Look

CFDs are powerful, but they are not for everyone. Here is a transparent breakdown of the pros and cons.

| ✅ The Pros (Why People Use Them) | ❌ The Cons (What to Be Careful Of) |

| Bypass Banks & Brokers: Trade directly with your crypto, saving on fees and time. | You Don’t Own the Stock: You get no shareholder voting rights or dividends (though the price is adjusted for dividend payouts). |

| 24/7 Market Access: Trade many global assets outside of their normal market hours. | Leverage is a Double-Edged Sword: It magnifies your profits, but it also magnifies your losses just as quickly. Never invest more than you are willing to lose. |

| Go Short, Too: The ability to profit from falling prices is a huge strategic advantage. | Platform Risk is Real: You are trusting the platform that hosts the CFD. Choosing a secure and reputable exchange is not just important—it’s everything. |

Disclaimer

Please note this article is for informational purposes only and does not constitute investment advice. Investors should conduct their own due diligence before making any investment decisions.

RELATED POSTS

View all